Contents:

Then to develop the style and design of the product, the amortization meaning with example spent $500. Therefore, the company will record the amortized fee at $100 per year for five years of patent ownership. An amortized loan is a type of loan that requires the borrower to make scheduled, periodic payments that are applied to both the principal and interest. You can find an online calculator that will find a complete amortization schedule for you with periodic payments and writing off the principal amount.

So, for example, if a new company purchases a forklift for $30,000 to use in their logging businesses, it will not be worth the same amount five or ten years later. Still, the asset needs to be accounted for on the company’s balance sheet. Amortization can be calculated using most modern financial calculators, spreadsheet software packages , or online amortization calculators. When entering into a loan agreement, the lender may provide a copy of the amortization schedule (or at least have identified the term of the loan in which payments must be made.

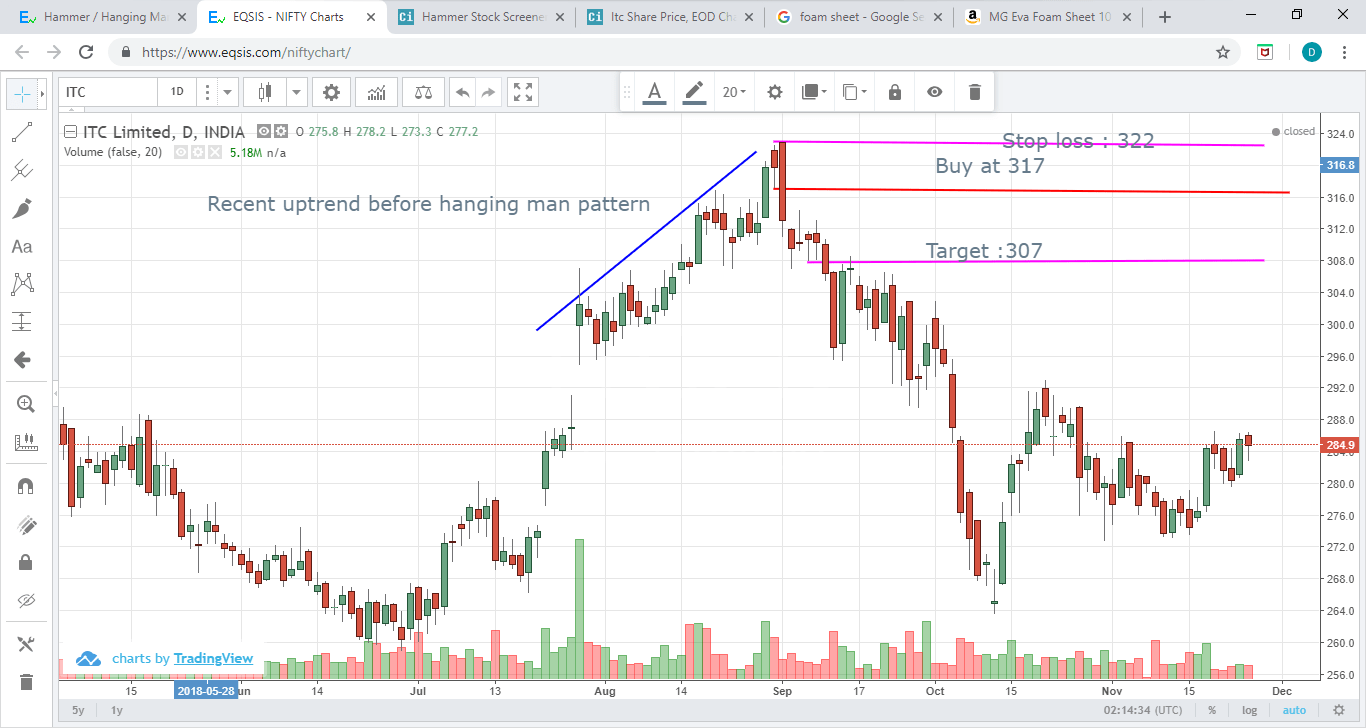

As the interest portion of the payments for an amortization loan decreases, the principal portion increases. Annual revenue adjusted for the merger fell 5 percent in 2022 to $43.1 billion, while adjusted earnings before interest, taxes, depreciation and amortization declined 12 percent to $9.2 billion. We’ve already discussed how to calculate the monthly installments in loan amortization and the amount of monthly interest.

How Do I Calculate Amortization?

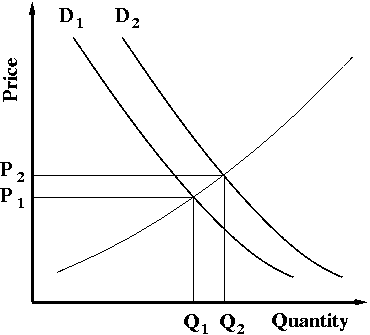

Tangible assets can often use the modified accelerated cost recovery system . Meanwhile, amortization often does not use this practice, and the same amount of expense is recognized whether the intangible asset is older or newer. When a company acquires an asset, that asset may have a long useful life.

For example, a company often must often treat depreciation and amortization as non-cash transactions when preparing their statement of cash flow. Without this level of consideration, a company may find it more difficult to plan for capital expenditures that may require upfront capital. Amortization is the process of spreading out a loan into a series of fixed payments.

Free Amortization Work Sheet

The expense would go on the income statement and the accumulated amortization will show up on the balance sheet. Since a license is an intangible asset, it needs to be amortized over the five years prior to its sell-off date. At times, amortization is also defined as a process of repayment of a loan on a regular schedule over a certain period. In general, to amortize is to write off the initial cost of a component or asset over a certain span of time. It also implies paying off or reducing the initial price through regular payments.

Amortization can refer to the process of paying off debt over time in regular installments of interest and principal sufficient to repay the loan in full by its maturity date. A higher percentage of the flat monthly payment goes toward interest early in the loan, but with each subsequent payment, a greater percentage of it goes toward the loan’s principal. The second situation, amortization may refer to the debt by regular main and interest payments over time. A write-off schedule is employed to reduce an existing loan balance through installment payments, for example, a mortgage or a car loan. Like the wear and tear in the physical or tangible assets, the intangible assets also wear down.

Amortization of Assets

Negative amortization is particularly dangerous with credit cards, whose interest rates can be as high as 20% or even 30%. In order to avoid owing more money later, it is important to avoid over-borrowing and to pay your debts as quickly as possible. The ending loan balance is the difference between the beginning loan balance and the principal portion.

Earthstone Energy, Inc. Reports 2023 First Quarter Financial Results – GlobeNewswire

Earthstone Energy, Inc. Reports 2023 First Quarter Financial Results.

Posted: Wed, 03 May 2023 20:09:56 GMT [source]

Understanding the loan amortization schedule on a loan you are considering or a loan you already have can help you see the big picture. By comparing the amortization schedules on multiple options you can decide what loan terms are right for your situation, what the total cost of a loan will be, and whether or not a loan is right for you. If you are trying to pay down debt, comparing the amortization schedules on your existing loans can help you determine where to focus your payments. Amortization tables typically include a line for scheduled payments, interest expenses, and principal repayment. A loan amortization schedule is a table that shows each periodic loan payment that is owed, typically monthly, for level-payment loans.

A type of loan or debt financing that is paid back to the lender within a specified time. The repayment structure of such a loan is such that every periodic payment has an interest amount and a certain amount of the principal. Instead, there is accounting guidance that determines whether it is correct to amortize or depreciate an asset. Both terminologies spread the cost of an asset over its useful life, and a company doesn’t gain any financial advantage through one as opposed to the other.

What is Amortization Period?

Consequently, the company reports an amortization for the software with $3,333 as an amortization expense. Calculation of amortization is a lot easier when you know what the monthly loan amount is. Interest due represents the dollar amount required to pay the interest cost of a loan for the payment period. Salvage value is the estimated book value of an asset after depreciation.

Home Equity Loan Amortization: How it Works – Credible

Home Equity Loan Amortization: How it Works.

Posted: Wed, 15 Mar 2023 07:00:00 GMT [source]

Not all loans are designed in the same way, and much depends on who is receiving the loan, who is extending the loan, and what the loan is for. However, amortized loans are popular with both lenders and recipients because they are designed to be paid off entirely within a certain amount of time. It ensures that the recipient does not become weighed down with debt and the lender is paid back in a timely way. The amortization rate can be calculated from the amortization schedule. The percentage of each interest payment decreases slightly with each payment in the amortization schedule; however, in the process the percentage of the amount going towards principal increases.

However, you can also prepare your loan amortization schedule by hand or in MS excel. Let’s look at the formula periodic payments in the loan amortization. Of the different options mentioned above, a company often has the option of accelerating depreciation. This means more depreciation expense is recognized earlier in an asset’s useful life as that asset may be used heavier when it is newest.

Why Do We Amortize a Loan Instead of Depreciate a Loan?

The borrower has security that he will pay the fixed interest respect regardless of the market fluctuations. However, another type of flexible-rate mortgage also exists when the lender has the power to change the rate. A fixed asset is a long-term tangible asset that a firm owns and uses to produce income and is not expected to be used or sold within a year.

The best way to understand amortization is by reviewing an amortization table. If you have a mortgage, the table was included with your loan documents. Amortization and depreciation are similar in that they both support the GAAP matching principle of recognizing expenses in the same period as the revenue they help generate. Refinancing the loan can help you save a lot of money in the monthly loan amortizations. This number represents the company’s value before depreciation and amortization. Is determined by dividing the asset’s initial cost by its useful life, or the amount of time it is reasonable to consider the asset useful before needing to be replaced.

Unlike intangible assets, tangible assets might have some value when the business no longer has a use for them. For this reason, depreciation is calculated by subtracting the asset’s salvage valueor resale value from its original cost. The difference is depreciated evenly over the years of the expected life of the asset. An amortization scheduleis often used to calculate a series of loan payments consisting of both principal and interest in each payment, as in the case of a mortgage. Though different, the concept is somewhat similar; as a loan is an intangible item, amortization is the reduction in the carrying value of the balance. Amortization is the accounting process used to spread the cost of intangible assets over the periods expected to benefit from their use.

Buyers may have other options, including 25-year and 15-years mortgages, the most preferred being the mortgage for 30 years. The amortization period not only affects the length of the loan repayment but also the amount of interest paid for the mortgage. In general, longer depreciation periods include smaller monthly payments and higher total interest costs over the life of the loan. Early in the schedule, the majority of each payment goes toward interest; later in the schedule, the majority of each payment begins to cover the loan’s remaining principal.

Here we shall look at the types of amortization from the homebuyer’s perspective. If you are an individual looking for various amortization techniques to help you on your way to repay the loan, these points shall help you. Learn how personal loan interest rates work, how rate types differ, and what the average interest rate is on a typical personal loan. An amortized bond is one that is treated as an asset, with the discount amount being amortized to interest expense over the life of the bond. Amortized loans apply each payment to both interest and principal, initially paying more interest than principal until eventually that ratio is reversed. The two accounting approaches also differ in how salvage value is used, whether accelerated expensing is done, or how each are shown on the financial statements.

- For book purposes, companies generally calculate amortization using the straight-line method.

- It also implies paying off or reducing the initial price through regular payments.

- In a loan amortization schedule, the percentage of each payment that goes toward interest diminishes a bit with each payment and the percentage that goes toward principal increases.

- Your additional payments will reduce outstanding capital and will also reduce the future interest amount.

Amortization helps businesses and investors understand and forecast their costs over time. In the context of loan repayment, amortization schedules provide clarity into what portion of a loan payment consists of interest versus principal. This can be useful for purposes such as deducting interest payments for tax purposes. In accounting, the amortization of intangible assets refers to distributing the cost of an intangible asset over time.

These assets can contribute to the revenue growth of your business. An example of an intangible asset is when you buy a copyright for an artwork or a patent for an invention. Borrowers and lenders use amortization schedules for installment loans that have payoff dates that are known at the time the loan is taken out, such as a mortgage or a car loan. There are specific formulas that are used to develop a loan amortization schedule. These formulas may be built into the software you are using, or you may need to set up your amortization schedule from scratch. First, the current balance of the loan is multiplied by the interest rate attributable to the current period to find the interest due for the period.